Hedging Strategy

Hedging is the life blood of traders who hold big positions. When they hedge, their aim is to reduce their risk drastically and also to find arbitrage opportunities from their hedging.

Where to go for hedging?

Enter Derivatives. Derivatives are instruments that are derived from the value of an underlying.

Basically derivatives are risk mitigation instruments. It exists to mitigate risk.

Why do Futures markets exist?

I’d like to give real-world examples to make readers understand the existence of future markets.

Let’s say there is an Aluminium Manufacturer. He would like to mitigate his risk on the prices of Aluminium. Why is he mitigating his risk? Simple, he doesn’t know what would happen to the prices of Aluminium over the future course of his business.

How would he do that?

Well, he goes to the “Futures Exchange” to sell his product. He could sell the forward contract of his product. In the forward contract, the probability of receiving a premium for his products is high and he’d sell contracts of Aluminum. Let me explain through a hypothetical case – let’s call him Manufacturer A. A sells 10000 contracts of Aluminium of 2 months forward assuming that we’re writing this on October 28 and he is selling futures of January contract. A is selling for 10000@ $200/ton. He’d be having $2,000,000 less trading fees in his ac. Say the spot prices are trading around $180. He is getting a premium of $20/Ton. Say at the time of January 28 Aluminium is selling at $180.

Hypothesis 1 – $180. He had made a profit of $20/ ton on hedging the contracts he sold. Anyhow he would be providing delivery of those contracts in physical goods. He’d continue his risk mitigation by doing the trade in forward contracts. He made his $20 on mitigating the risk. But in real terms, there is no change in prices. He would keep on continuing to manufacture Aluminium. He would continue to sell his current obligations in spot markets by delivering to his regular customers. This is what we call hedging. In this case, the manufacturer has mitigated the risk by selling in future markets. He would continue to sell his products as he has to do it to continue his business. In future markets, he wouldn’t have a substantial premium yet he would continue to do it simply to manage the risk.

Hypothesis 2 – $220. He had made a loss of $20/ ton on hedging the contracts he sold. Anyhow he would be providing delivery of those contracts in physical goods. He’d continue his risk mitigation by doing the trade in forward contracts. He lost $20 on mitigating the risk. But it wouldn’t affect him as he simply mitigated the risk by placing future contracts. Anyhow he is going to settle the contracts with his Aluminium. He sold the Aluminium at $200 when the spot was around $180. This is how a manufacturer mitigates the risk. In the forthcoming forward expiry contracts, he would probably fetch more premium for his products. It’s a win-win situation for him.

Now replicate this to crypto and we could understand the concept of derivatives and risk mitigation it plays on the underlying instrument.

Now let’s come to crypto perpetual. It’s futures without expiry.

Biggest issue with this kind of mitigation is price disruption. What is price disruption?

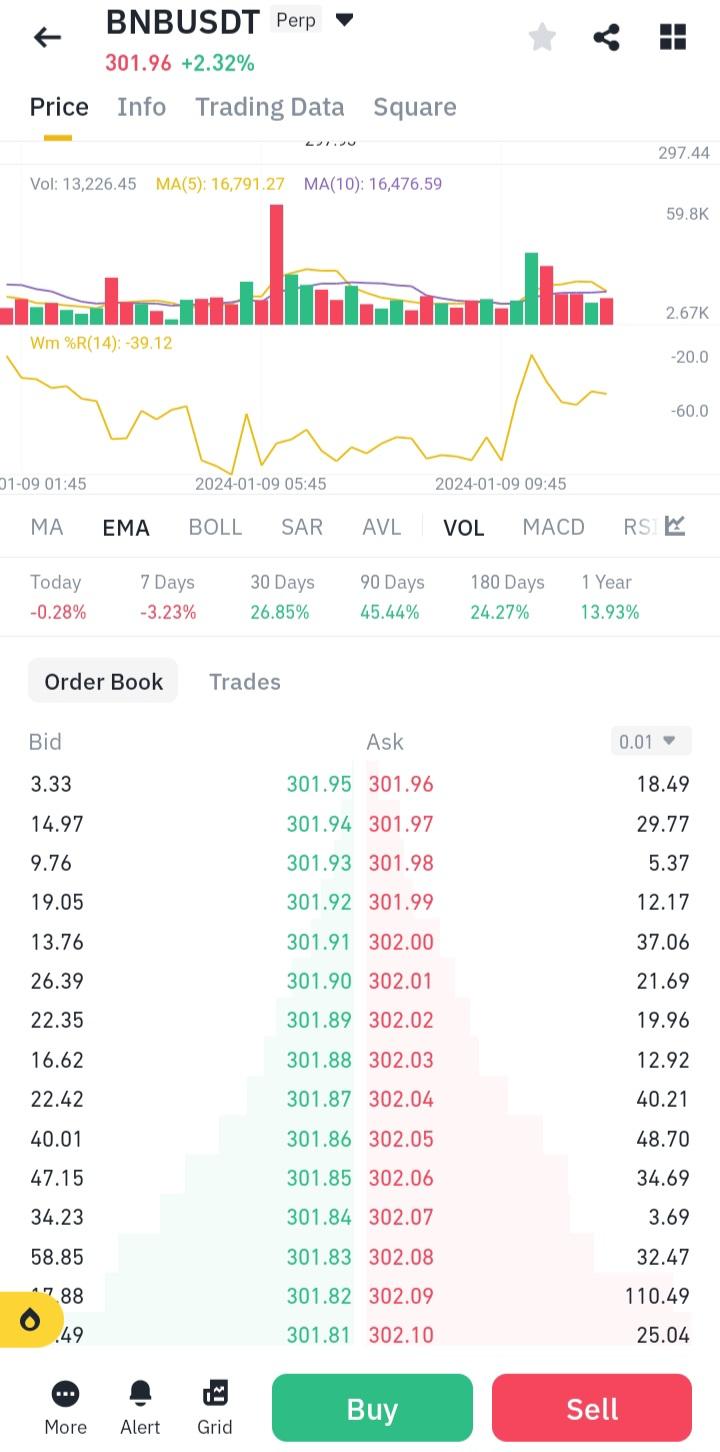

Have a look into this order book. Let’s say you hold 1000 BNB tokens. You’d like to do hedging of your BNB tokens. How do you sell 1000 tokens? It’d simply disrupt the prices. This screenshot is from Binance. Binance is No.1 in volumes for perpetuals. This issue would obviously create slippages and issues on liquidity depth of the order book. If and when bulk of selling is coming , it’s obvious that price disruptions are bound to happen.

You’re bound to lose a few percentage points on your hedging.

How to hedge without price disruption?

Enter Swaps. Swaps are nothing but a type of derivative in which cash flows are exchanged based on price movements of underlying assets based on the Notional amount.

To know more about Swaps

All you’ve to do is to choose the notional based on your funds and hedge the underlying without price disruptions.

Leave a Reply